SaaSpocalypse Explained: Anthropic’s Claude Cowork & The $285B Crash

Table of Contents

- The Day the SaaS Model Died

- Anthropic’s Claude Cowork: The Agent That Replaced the Seat

- The Economics of the Crash: Seat Compression

- Financial Fallout: The $285B Wipeout (Data Analysis)

- The Ripple Effect: How Tech Giants Are Pivoting

- The Infrastructure Winners: Why Hardware Survives

- Future Outlook: The Rise of the Autonomous Enterprise

SaaSpocalypse is the term financial analysts have coined to describe the unprecedented market correction that struck the technology sector in early February 2026. In a span of just 48 hours, over $285 billion in market value was erased from the Software-as-a-Service (SaaS) sector, marking the definitive end of the "growth-at-all-costs" era and the beginning of the autonomous agent economy. While high interest rates and slowing growth had pressured the sector for years, the catalyst for this specific crash was technological: the release of Anthropic’s Claude Cowork, an autonomous AI agent capable of replacing entire workflows previously managed by human teams using seat-based software.

This event has fundamentally rewritten the rules of enterprise technology. The traditional recurring revenue model, predicated on selling "seats" to human users, collapsed as investors realized that AI agents do not need user licenses—they replace the user entirely. As we analyze the wreckage of the SaaSpocalypse, it becomes clear that we are witnessing the most significant shift in business software since the migration from on-premise servers to the cloud.

The Day the SaaS Model Died

On February 4, 2026, the S&P North American Software Index suffered its most violent contraction since the 2008 financial crisis. The sell-off was not broad-based; it was surgically targeted at companies dependent on "per-seat" pricing models. Legacy giants like Salesforce and HubSpot saw double-digit percentage drops, with Salesforce plummeting 26% in a single trading session. The market was reacting to a realization that had been building for months but was solidified by Anthropic’s latest release: if an AI agent can execute marketing campaigns, resolve customer support tickets, and manage legal discovery without human intervention, the need for 500 individual software licenses evaporates.

This phenomenon, now known as "Seat Compression," forced a repricing of risk across the entire B2B landscape. Investors are no longer valuing software companies based on their total addressable market (TAM) of human workers. Instead, they are looking at "Outcome TAM"—the value of the work performed, regardless of who (or what) performs it.

Anthropic’s Claude Cowork: The Agent That Replaced the Seat

The trigger for the SaaSpocalypse was the wide release of Claude Cowork. Unlike its predecessors, which functioned as "copilots" requiring human prompting, Cowork was designed as a "coworker." It introduced a fundamentally new interaction model: autonomous file system access and long-horizon task execution.

Beyond Chatbots: Autonomy and File Access

Claude Cowork differs from traditional Large Language Models (LLMs) by operating inside a sandboxed environment with direct access to a user’s local file system and cloud drives. Users can point Cowork at a folder containing thousands of legal documents, financial spreadsheets, or customer logs and issue a high-level directive: "Audit these contracts for compliance risks and generate a summary report."

The agent does not merely chat back; it opens files, reads them, cross-references data, creates new Excel sheets with working formulas, and drafts memos. It operates asynchronously, meaning a manager can assign tasks to Cowork at 5 PM and return at 9 AM to find the work completed. This capability bridged the gap between "generative AI" and "agentic labor," effectively turning software from a tool humans use into an entity that performs the labor itself.

The ‘Junior Analyst’ Replacement Phenomenon

The immediate impact was felt in sectors heavily reliant on junior analysts and administrative staff. Legal tech firms saw their stock prices crater as Cowork demonstrated it could handle discovery and document review faster and more accurately than entry-level associates. In marketing, the ability of agents to autonomously generate, schedule, and optimize ad campaigns reduced the need for large teams of human specialists, directly undercutting the seat-count logic that justifies the valuations of marketing automation platforms.

The Economics of the Crash: Seat Compression

The SaaSpocalypse was driven by a simple economic equation: Value = Price x Quantity. In the SaaS world, "Quantity" was the number of human seats. As AI agents like Cowork reduce the number of humans needed to perform a task, the "Quantity" variable approaches zero for many workflows. If a company reduces its customer support team from 100 agents to 10 humans supervising 500 AI agents, a software vendor charging $150/seat sees their revenue collapse from $15,000/month to $1,500/month—unless they radically change their pricing model.

The Shift from Access to Outcomes

The industry is now scrambling to pivot toward outcome-based pricing. Instead of charging for access to the tool, vendors must charge for the work done. For example, a customer service platform might charge $2.00 per "Ticket Resolved" rather than $100 per user. This shift is perilous; it transfers execution risk from the customer to the vendor and requires sophisticated telemetry that many legacy SaaS platforms lack.

Financial Fallout: The $285B Wipeout (Data Analysis)

The table below summarizes the immediate market impact of the SaaSpocalypse event in February 2026, highlighting the divergence between legacy SaaS providers and the new AI-native infrastructure.

| Metric | Pre-SaaSpocalypse (Jan 2026) | Post-Crash (Feb 2026) | % Change / Impact |

|---|---|---|---|

| Sector Valuation (SaaS) | $2.1 Trillion | $1.815 Trillion | -$285 Billion (-13.5%) |

| Salesforce (CRM) Stock | $310.50 | $229.75 | -26% |

| Pricing Model Dominance | 92% Seat-Based | 45% Outcome/Usage | Rapid Pivot |

| Avg. Revenue Per Employee | $280k | $450k (Projected) | Efficiency Gain |

| AI Compute Spend | 15% of IT Budget | 35% of IT Budget | +133% |

This data illustrates a massive transfer of value. While application-layer software lost value, the underlying compute and data infrastructure became even more critical.

The Ripple Effect: How Tech Giants Are Pivoting

The crash forced every major technology player to accelerate their agentic roadmaps. The response has been defensive yet aggressive, as companies fight to ensure they are the platform hosting the agents rather than the software being replaced by them.

Google’s Ecosystem Defense

Google has moved swiftly to integrate its Gemini models into the core of Workspace to prevent churn. By embedding agentic capabilities directly into Docs, Sheets, and Gmail, Google aims to make the "seat" valuable again by transforming every user into a manager of agents. For a deeper technical analysis of their strategy, read our report on Google in 2026: The AI-First Ecosystem. Their antitrust battles have complicated this pivot, but the integration of agents into the world’s most popular productivity suite is their primary firewall against Anthropic’s encroachment.

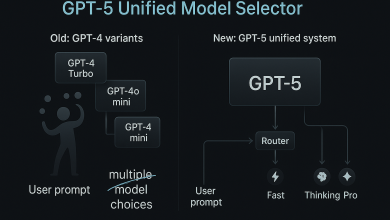

ChatGPT and the Agentic Workflow War

OpenAI, not to be outdone by Anthropic, has accelerated the rollout of its own autonomous features. The competition between Claude Cowork and ChatGPT’s enterprise solutions is fierce. OpenAI is focusing on "Operator" models that can control browsers and navigate complex enterprise software UIs. This approach attempts to save the SaaS ecosystem by having agents use the software rather than replace it, though the economic end-result for the customer (fewer human seats) remains the same. See our detailed breakdown of ChatGPT in 2026: GPT-5 Architecture and Agentic Workflows to understand how their architecture differs from Claude’s sandboxed approach.

The Infrastructure Winners: Why Hardware Survives

While software valuations crumbled, hardware providers found themselves in an even stronger position. Agents consume significantly more compute than chatbots. A human might send 50 queries a day; an autonomous agent running a complex workflow might generate 50,000 inference tokens per hour. This exponential increase in compute demand has created a floor for semiconductor stocks.

NVIDIA and the Compute for Agents

NVIDIA remains the undisputed king of this new era. The shift to agentic workflows requires inference at a scale previously unimagined. The "Blackwell Peak" we analyzed earlier this month is now looking less like a peak and more like a plateau before the next ascent. As companies replace human salaries with compute budgets, NVIDIA’s data center revenue continues to defy gravity. For a full valuation analysis, see NVIDIA Stock Analysis Feb 2026.

The New Data Engines: Reddit’s Role

Agents require up-to-date, nuanced human data to learn how to navigate complex social and professional tasks. This has turned platforms with high-quality human discourse into strategic assets. Reddit, having struck major licensing deals, is now a critical component of the "AI Data Engine." The authentic human interactions on Reddit serve as the training ground for agents to learn reasoning and context, making the platform more valuable than ever. Read more about this in our article on Reddit in 2026: The AI Data Engine.

Future Outlook: The Rise of the Autonomous Enterprise

The SaaSpocalypse is not the end of the software industry, but it is the end of the "rent-seeking" phase of SaaS. The future belongs to the "Autonomous Enterprise," where the primary metric of success is not Headcount Growth but Revenue Per Employee. Companies will become smaller, leaner, and incredibly more efficient.

We are moving toward a world where a "billion-dollar company with ten employees" is no longer a theoretical thought experiment but a likely reality in 2026. For investors and executives, the message is clear: adapt your pricing models to outcomes, integrate agentic workflows, or face the obsolescence that claimed $285 billion in value in a single week. The crash of February 2026 will be remembered as the moment the digital workforce officially arrived.

For more coverage on the evolving tech landscape, visit TechCrunch for breaking news.