Alphabet Stock Analysis: Q4 Earnings Beat and $185B AI Bet

Alphabet Inc. (NASDAQ: GOOGL) continues to dominate the global technology landscape in early 2026, delivering a robust start to the year with Q4 2025 earnings that surpassed Wall Street expectations. However, despite a revenue beat of $113.83 billion, investor sentiment remains mixed as the company announced a staggering $175-$185 billion capital expenditure guidance for 2026. This aggressive spending plan underscores CEO Sundar Pichai’s commitment to winning the AI arms race against competitors like the newly merged SpaceX-xAI giant and Microsoft.

Alphabet Q4 2025 Earnings: A Double Beat

On February 4, 2026, Alphabet released its financial results for the quarter ending December 31, 2025. The tech giant reported earnings per share (EPS) of $2.82, comfortably beating the consensus estimate of $2.59. Revenue climbed 18% year-over-year to $113.83 billion, driven largely by a resurgence in digital advertising and explosive growth in Google Cloud.

The company’s ability to maintain double-digit growth in its core Search business, even amidst the rise of generative AI search engines, has reassured some skeptics. However, the market reaction was tepid, with the stock dipping 7% in after-hours trading immediately following the call, primarily due to sticker shock over projected infrastructure spending.

| Metric | Q4 2024 | Q4 2025 | YoY Change |

|---|---|---|---|

| Total Revenue | $96.5B | $113.8B | +18% |

| Earnings Per Share (EPS) | $2.15 | $2.82 | +31% |

| Google Cloud Revenue | $11.9B | $17.6B | +48% |

| Operating Margin | 27% | 31.6% | +460 bps |

The $185 Billion AI Gamble: CapEx Concerns

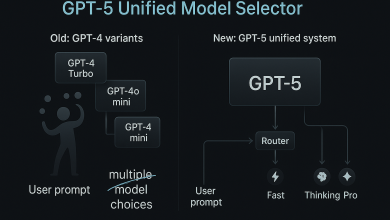

The most debated topic on the earnings call was the forecast for 2026 capital expenditures. Management guided for $175 billion to $185 billion in spending, a massive leap from 2025 levels. Approximately 60% of this budget is allocated to servers and data centers, specifically to support the next generation of Gemini models and the rumored “Android XR” platform.

This spending spree directly benefits hardware suppliers. Analysts note that a significant portion of this budget will likely flow to chip manufacturers, sustaining the demand cycle discussed in recent Nvidia stock analysis. While investors worry about margin compression, Google argues that this infrastructure is the “moat” required to serve the 2 billion monthly users expected to adopt agentic AI workflows by the end of the year.

Cloud & Gemini: The Growth Engines

Google Cloud remains the star performer, with revenue surging 48% year-over-year. The division is finally reaping the rewards of its deep integration with Gemini 2.5 and the upcoming Gemini 3 model. The cloud backlog now stands at a record $240 billion, up 55% sequentially, indicating that enterprise customers are locking in long-term AI compute contracts.

Adoption is also being driven by the Apple-Gemini partnership, which is expected to contribute between $1 billion and $7 billion in high-margin revenue as iPhone 17 users engage with on-device generative AI features. This ecosystem lock-in is critical as competitors like Alibaba and Meta ramp up their own infrastructure.

Waymo’s Global Expansion: $16B Funding Secured

Alphabet’s “Other Bets” segment delivered a major headline on February 2, 2026, with Waymo raising $16 billion in an external funding round led by Dragoneer and Sequoia, valuing the autonomous driving unit at $126 billion. This capital injection is earmarked for aggressive global expansion.

New Markets and Milestones

Waymo confirmed plans to launch ride-hailing services in over 20 new cities in 2026, including its first international forays into London and Tokyo. With weekly paid rides now exceeding 450,000 across six U.S. metros, Waymo has moved from a research project to a commercial reality, outpacing rivals like Tesla in the robotaxi sector.

Antitrust Update: DOJ Appeals and Wiz Deal Approval

Regulatory pressure remains a constant headwind. On February 4, 2026, the Department of Justice (DOJ) and a coalition of states filed an appeal against Judge Amit Mehta’s remedies ruling. While the judge rejected the extreme measure of breaking up Chrome or Android, he ordered Google to rebid its default search contracts annually—a move that introduces uncertainty into its lucrative deal with Apple.

However, it wasn’t all bad news on the regulatory front. On February 10, the European Commission officially approved Google’s $32 billion acquisition of cybersecurity firm Wiz. This deal is expected to bolster Google Cloud’s security offerings, further differentiating it from AWS and Azure. The approval signals that while President Trump’s administration may have a complex relationship with Big Tech, global M&A activity is not entirely frozen.

2026 Stock Forecast: Is the Dip a Buy?

Despite the post-earnings dip, most analysts retain a “Buy” rating on Alphabet. The valuation remains attractive compared to peers, trading at roughly 19x forward earnings. The consensus view is that the market is temporarily overreacting to the CapEx guidance, ignoring the long-term revenue potential of the AI transition.

For investors, the key metric to watch in Q1 2026 will be the operating margin. If Google can maintain margins above 30% while investing $185 billion in infrastructure, the stock is likely to rebound toward new all-time highs. For more financial news, you can follow updates on Bloomberg.